Farmland vs Gold - What is Right Investment Option for You?

Arguably the world's oldest and most significant asset groups are farmland and gold, and they exhibit many common attributes that purchasers find interesting even now. Surprisingly though, investment in agriculture has been mostly disregarded in current times.

Therefore, this might actually add value to take a glance, as farmland properties has traditionally beaten gold bets in almost every regard.

We suggest putting money in farmland will be much more lucrative over gold for the reasons stated that have maintained recent decades:

⦁ Stronger inflation hedge

⦁ Consistent, regular revenue

⦁ Higher the return with lower volatility

⦁ Positive demand and supply

Stronger inflation hedge

To be honest, gold investments are more about “return of your money " and less about " return on your money ".

Fears about currency devaluation and spending deficit have been some of the reasons many people buy gold, particularly during the current downturn.

Inflation hedge is an asset intended to safeguard one’s buying power as the price of money declines and the cost of things increases.

Since gold remains a global market interest, its worth is not linked to any one currency. So as the real exchange rate declines, the comparative worth of each gram of gold normally climbs.

This is particularly true in periods of crisis and downturn, as people tend to migrate towards more reliable investments.

Inflation effects upon agricultural values a slightly different way. Consumable food costs are more subject to rising prices than almost any other category of product.

Although gold has functioned as an excellent hedge against inflation, farmland prices have traditionally linked inflation more precisely, with a 79.84 percent correlation with its Producer Price Index (PPI) and a with a 70 percent connection with the Consumer Price Index (CPI)

No other investment vehicle follows this accurately to these two primary indices of inflation.

With this basis farmland has provided stable returns while showing to be a more successful hedge against inflation.

Best Choice: Farmland

Consistent, regular revenue

Gold, as a non-producing physical asset, generates no revenue throughout the holding time.

Any financial benefit you expect to earn is reliant on someone else offering a greater price when you resell it.

With farmland assets, you may not only profit from the land's value, but you can also profit from the food production it delivers every year.

This is a distinct benefit of farmland assets over gold investments.

We are not claiming that gold has no long-term worth.

However, as comparison to farmland, gold has risen at a slower rate and does not have the ability to produce an annual cash income during the holding term.

Best Choice: Farmland

Higher the return with lower volatility

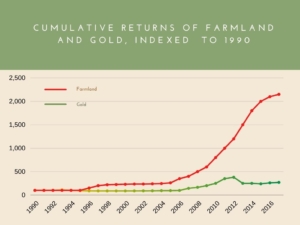

While gold has increased in value through most of time, it has also caused losses exceeding 30 percent in a single year. But at the other side, farmland has produced positive cumulative annual growth over the last two decades, as land investments usually make money through cash rentals given by farmers every year on addition of any gain in land value.

When comparing the entire average returns of farmland and gold, there has been a definite winner. Not only has farmland given greater returns than gold in total, it has delivered less volatility, as seen in the figure below.

In addition, agricultural returns do not correspond with stock market performance, thus it may provide genuine diversity to a conventional investment portfolio.

Best Choice: Farmland

Positive demand and supply

The principles of supply and demand are also influencing agricultural and gold prices.

While gold is in plentiful supply in comparison to demand, cropland production has been progressively declining, even as global need for food continues to rise.

According to The World Gold Council, the world supply of gold has continued to increase at a rate of little over 1% each year.

Global gold mining contributes around 2,500-3,000 tons to the total above-ground supply per year.

As the price of gold rises, so does the profit of mining operations, and as a result, gold output rises as well.

When you might expect, the value of each gram of gold could be diluted as supply outnumbers demand.

In comparison, we can see in the graph below that farmland is already in short supply as the population has grown and more land has been utilized for other uses.

As we saw in our look at global agricultural supply forecasts through 2050, this trend is only projected to continue.

Best Choice: Farmland

Conclusion

Both farmland and gold are appealing diversifiers for investors' wallets, and both should be taken into account for a well-balanced asset allocation. While both farmland and gold investments may provide investment diversity and inflation hedges, farmland has consistently beaten gold over times and offers many of the same advantages in a more appealing manner. If you've never considered purchasing in farmland to diversify your portfolio, now is the moment.